Those that are in the Lynnwood, WA area are going to find that owning a home is a good long-term housing option. With owning a home, you are going to have a stable place to live and can enjoy the long-term advantages that come with property ownership. Along with buying a home, you also need to choose the right insurance plan. There are a few situations in which someone should get home insurance.

Intent to Comply with Requirements

The first situation in which someone will want to get a home insurance plan will come when they want to comply with insurance requirements. It is very common to finance a purchase of a home with a mortgage. If this is how you financed your home purchase, you will undoubtedly need to get an insurance plan for it to comply with your lender’s requirements. In many cases, they will require that you have your payments escrowed each month.

Obtain Coverage for Assets

You also should get this coverage to ensure your assets are protected. When you buy a home, you will be making a major investment that you will want to enjoy for a long time. The best way you can do this is by getting a home insurance plan as it will offer you support if you incur a loss due to a fire, bad weather, or other challenging situation. This plan can also include a coverage provision for your personal assets.

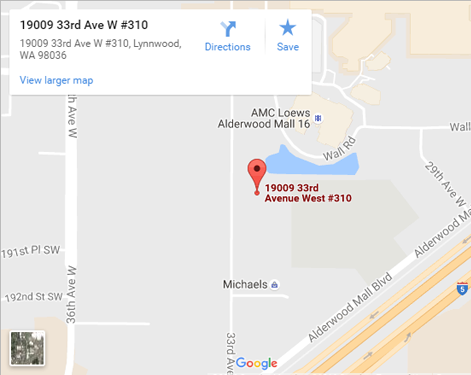

As you are looking to get coverage in the Lynnwood, WA area, it would be helpful to call Sound Choice Insurance Agency Inc. The team with Sound Choice Insurance Agency Inc understands the complexities that come with home insurance. They can offer the support you need to build a plan and maintain proper coverage moving forward.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions