Whether you’re an entrepreneur, a startup, or a multinational corporation, protecting your business with adequate insurance is essential. Ensure your commercial insurance policies provide comprehensive and up-to-date coverage by consulting the local insurance experts at Sound Choice Insurance Agency Inc. in Lynwood, WA.

Is Your Commercial Insurance Up-to-Date?

Modern commercial insurance policies go beyond simply protecting your bottom line. Comprehensive coverage can safeguard your business finances, employees, equipment, proprietary data, fleet vehicles, and provide general liability protection.

Auto Insurance: Commercial insurance policies can include coverage for company vehicles used for business operations. Local business owners can secure individual or comprehensive auto policies as part of a commercial insurance bundle. Speak with a trusted local insurance agent to review your current auto policy and get a quote for individual or fleet vehicles.

Business Owners Policy (BOP): A BOP combines key features of comprehensive commercial insurance policies with general liability and property insurance. Choosing the right policy for your business requires a careful review of your income, assets, liabilities, and potential risks.

Cyber Liability Insurance: Cyber liability insurance is a vital add-on for businesses that handle sensitive customer data and financial records. This coverage protects against cyber incidents, including data breaches, theft, and leaks of proprietary information.

General Liability Insurance: General liability insurance protects your business from claims related to slips and falls, property damage, and other covered incidents, helping safeguard your brand and financial stability.

Workers’ Compensation Insurance: Workers’ compensation insurance protects your business and employees from financial losses due to on-the-job accidents or injuries, ensuring stability during unexpected events.

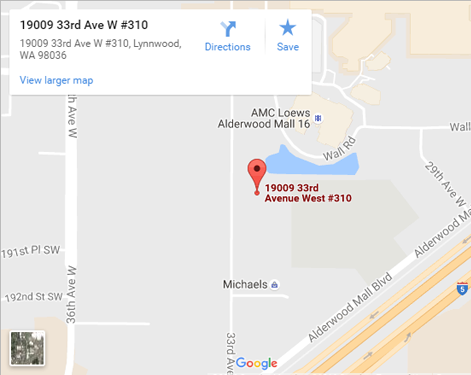

Contact the commercial insurance experts at Sound Choice Insurance Agency Inc. today to learn more about how we can help protect your business!

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions