Home insurance in Lynnwood, WA, is designed to protect you during emergencies. Unfortunately, emergencies can sometimes result in your belongings being stolen or damaged. It’s essential to determine whether your home insurance will cover the replacement of these items before an incident occurs.

Covered Perils

Many home insurance policies include personal property protection, which covers your belongings up to a certain limit. To determine your coverage limit, consult an agent at a reputable insurance company, such as Sound Choice Insurance Agency Inc.

However, homeowners’ insurance only covers personal belongings if they are damaged or stolen due to a covered event. Your policy will list specific covered perils, which commonly include:

- Lightning

- Robberies

- Wind damage

- Fire

Some natural disasters may be covered, but many homeowners’ insurance policies require additional coverage for specific events, such as floods or earthquakes.

Common Exclusions

Home insurance policies often exclude certain types of damage or events. For example, flood damage, including water damage in the basement, is typically excluded and requires a separate flood insurance policy. Other common exclusions include:

- Intentional damage

- Damage caused by a roommate

- Damage caused by pets

- Hurricanes

- Tornadoes

- Power surges

- Earth movement, including earthquakes

- Volcanic eruptions

- Wildfires

While these exclusions are common, many insurance companies offer additional coverage options for purchase. An agent can help you determine the type of insurance you need to ensure peace of mind.

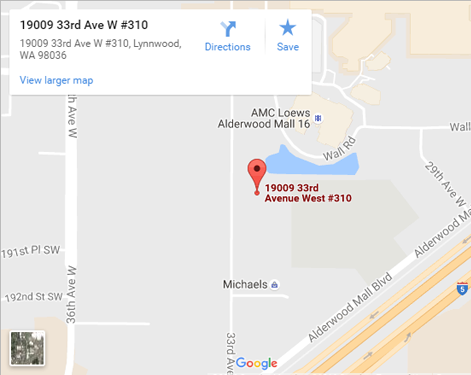

At Sound Choice Insurance Agency Inc., we understand the importance of having the right coverage before an emergency occurs. We recommend creating a detailed inventory of your personal property to ensure you have adequate coverage to replace your belongings in the event of a loss. Contact us today to learn more. We proudly serve the Lynnwood, WA, area.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions