Coverage for your hot rod can be challenging to get. But whether you live in Washington State, Arizona, California, Colorado, Georgia, Idaho, Oregon, or South Carolina, Sound Choice Insurance Agency Inc. in Lynnwood, WA, can help you find the best coverage possible for your race car.

Coverage for Street-Legal Racing Cars

If your race car is legal on the street, Sound Choice Insurance Agency Inc. can help you find liability insurance, collision insurance, and comprehensive insurance to protect you in case of accidents, theft, vandalism, and other hazards. We can help you find the same kinds of coverage we offer classic car owners, even agreed-value insurance that considers your car worth more than the Kelly Blue Book value.

Limited Trailer and Paddock Coverage

If your car is not street legal, you can get LTP, limited trailer, and paddock coverage. LTP protects race cars, dragsters, hot rods, street rods, and many racing motorcycles when they are in the garage and when they are transported to an event. This kind of coverage covers your car when it is being loaded or unloaded, serviced, on display, or in storage.

Ask us about insurance for cars used in high-performance driver’s training events, track days, and autocross. We can also help you get coverage for both street-legal and off-road cars you take to Canada.

Racing Car Insurance Isn’t Just for Racing Cars

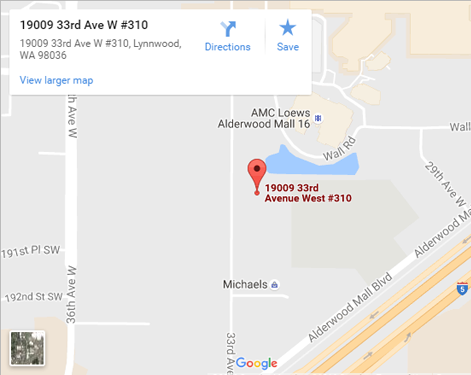

Sound Choice Insurance Agency Inc. in Lynnwood, WA, offers customers across the USA coverage for motorsports facilities, liability coverage in excess of the limits offered by sponsoring organizations, and commercial insurance for teams and repair shops.

Sound Choice can help you find the coverage you need. Call us today!

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions