The state of Washington is an “at-fault” state. This means that the court determines who is the person at-fault, for causing an accident, and makes that party responsible. There is a legal requirement in the state of Washington for anyone operating a vehicle within the state to have auto insurance that is at least a bare minimum.

Shared Fault

Sometimes an accident is caused by the fault of more than one person. In such a case, the court will decide of what percentage is each party’s fault and divide the fault up between all the parties that the court decides had some part in causing an accident.

These types of accidents are the ones that typically are heavily disputed. Assigning fault is somewhat of an arbitrary decision. Some facts and decisions about them can be rule-based; however, much of the final determination may come down to a matter of a judge’s opinion.

The Advantages of No-Fault Insurance

No-fault insurance does not require a determination to be made by the court regarding who caused the accident. The insurance provides coverage for the insured party, up to the limits of the policy, regardless of who is at fault. If there is other insurance available to help pay for the claim, then the insurance company will seek reimbursement from the other insurance company.

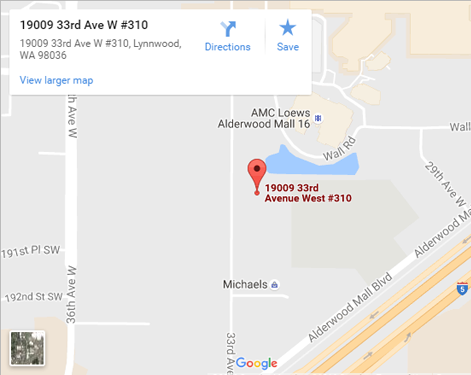

Ask your agent at Sound Choice Insurance Agency Inc, serving Lynnwood, WA and the surrounding area, to give you good advice about no-fault coverage.

Even though there is no legal requirement to carry no-fault insurance in the state of Washington it may still be a wise decision to have it for protection if the driver causing the accident is operating the vehicle illegally without insurance or is underinsured.

Contact your agent at Sound Choice Insurance Agency Inc in Lynnwood, WA to get an auto insurance review and a quote for no-fault auto insurance.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions