Own a business in Lynnwood, WA?

Then you absolutely must have commercial insurance before you open for business. Why? Because, first of all, the law requires it and secondly, your business is an asset that needs to be protected. But that’s not all. Read on to discover why having commercial insurance is so vitally important before you start doing business.

Protect your Asset

In the event that something devastating happens while you are doing business in Lynnwood, WA, you need to be protected. For example, your business could burn to the ground and if you’re not covered, you’ve just lost everything. You also need to think about lawsuits. Depending on what kind of business you run, the door for a potential lawsuit to be filed will be different. For example, if you own a taxi service and one of your vehicles strikes and kills a person, your company is liable. If you own a retail store and a customer slips and falls on the floor, breaking their leg, they could sue you.

Protect your Employees

If your business has employees, you need to protect them as well. This typically includes having worker’s compensation insurance and unemployment insurance for your employees.

What does Business Insurance Cost?

This will depend on what type of business you own and how many employees you have, if any. Other factors include the location and size of your business as well as your annual revenue.

To find out more about purchasing commercial insurance for your business, contact the team at Sound Choice Insurance Agency, Inc. Our agents are reputable, knowledgeable, and available to answer all your questions. Call Sound Insurance Agency, Inc today to find out more.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

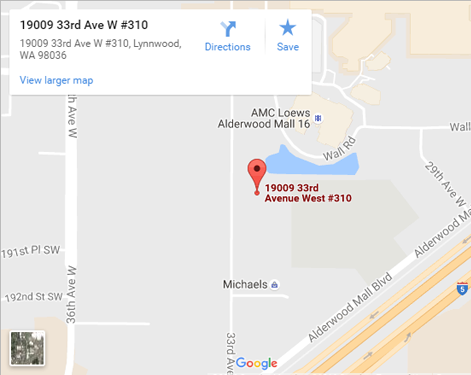

Get Directions