The New Year often brings changes to people’s lives. If upgrading your home is one of those changes, make sure to update your insurance accordingly. Home renovations can alter your current home insurance coverage. By updating your home insurance policy from Sound Choice Insurance Agency Inc in Lynnwood, WA, you can continue to receive the protection you need.

How do home renovations affect your home insurance?

Increase Home Value

Major home renovations like a kitchen remodel or a new patio can increase your home’s value. A substantial increase in home value could make your current dwelling coverage insufficient to protect your property. Your dwelling insurance should be enough to cover the cost of replacing your home in the event it’s totally destroyed in a catastrophe. By assessing the value of your home after the renovations are done, you’ll know if you need to increase your dwelling coverage to fully protect your property.

Alter Coverage

Home renovations will need to be added to your home insurance in order to be protected against unforeseen perils. Home renovations will alter your current dwelling coverage, making it necessary to update your policy.

Reduce Insurance Costs

Some home renovations such as upgrading your plumbing or electrical systems, installing energy-efficient windows or installing a new security system can help reduce your home insurance costs. A new plumbing and electrical system will reduce your risk of water and fire damage. A new security system can protect your home against theft, vandalism, and intrusion. By enhancing your home’s safety and security, you could qualify for a discount on your home insurance.

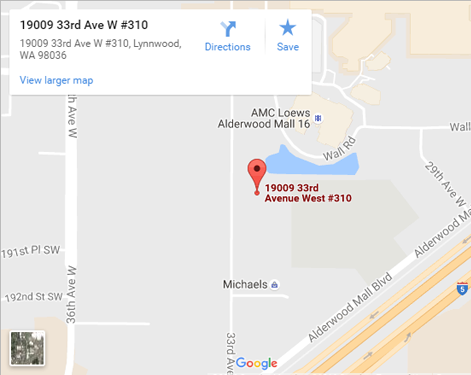

If home renovations are on your agenda for 2020, contact Sound Choice Insurance Agency Inc in Lynnwood, WA about updating your home insurance to maintain optimal coverage. We look forward to meeting your home insurance needs.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions