Starting a thriving and productive business venture in Washington presents unique risks. Different risks ranging from a client’s injuries, a client filing a lawsuit, to a natural peril striking are probable propagators of loss to your business. Without commercial insurance, it may force you to settle costly damage and legal suits out of pocket culminating in detrimental financial consequences. Some scenarios may impact your business negatively, culminating in a shutdown. Are you at an impasse about finding the right commercial coverage for your business entity in Lynnwood, WA? Please visit our agents at Sound Choice Insurance Agency Inc today.

Is commercial insurance necessary?

Buying good commercial insurance from Sound Choice Insurance Agency Inc. provides a broad spectrum of benefits, including:

Covering of advertising liability

If your business entity infringes on any copyright rule of other existing businesses or parties, liability insurance, comes in and caters to any legal liability against such accusations.

Safeguarding your employees

Worker’s comp insurance is mandatory in Washington for several business entities harboring employees. Hence, it’s paramount to have workers’ comp insurance that caters to work-related injuries or sickness for employees working on your premises. They are also guaranteed missed wages and funeral benefits.

Protection from lawsuits

In the litigious society we thrive in, especially in Lynnwood, WA, there is a likelihood of being sued by either a client or an employee. Any business is prone to impending expensive lawsuits. There is no reason to get stressed because your workers’ comp insurance chips in and settle the lawsuit fees.

It protects business assets.

Businesses are subject to unanticipated phenomena like vandalism and hailstorms ravaging your business assets. Procuring prolific commercial insurance from Sound Choice Insurance Agency Inc. will cushion your business assets like computers and furniture from imminent perils.

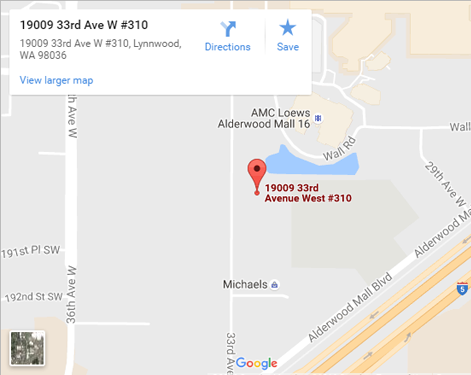

Are you a business owner searching for salient commercial insurance in Lynnwood, WA? Please don’t hesitate to speak to our dedicated agents at Sound Choice Insurance Agency Inc. and get more information about commercial insurance.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions