Protect Your Home with the Right Homeowners Insurance

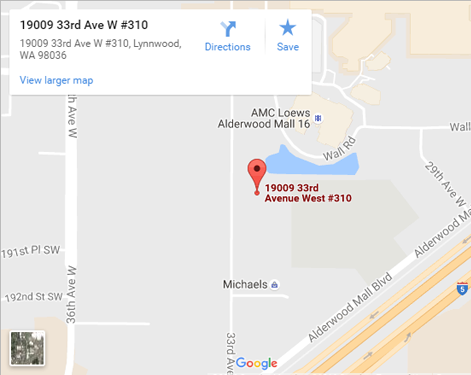

Homeowners insurance stands as the frontline defense for safeguarding your most prized asset – your home. Sound Choice Insurance Agency Inc, servicing Lynnwood WA, dedicates its expertise to help you navigate through insurance complexities and settle on the most fitting policy for your unique needs.

Questions to Fuel Your Policy Shopping

Understanding your insurance needs can be quite puzzling. Here are a few carefully chosen questions that can guide you while shopping for your homeowner’s insurance policy:

What Will My Homeowners Insurance Cover?

A standard homeowners insurance policy typically shoulders the cost to repair or replace your home’s infrastructure and the valuable items within, arising from a covered event. Whether it’s a devastating fire, unfortunate theft, offensive vandalism, or disruptive windstorms, your policy will have your back. Some policies even extend coverage to detached structures like your garage or shed. Reviewing each policy carefully before purchase ensures you recognize your coverage boundaries.

Can I Rebuild and Replace My Possessions Affordably After a Covered Event?

Understanding the extent of coverage and its sufficiency can puzzle even the best of us. It’s paramount to ensure that your policy provides enough to rebuild and replace everything following a covered event. At Sound Choice Insurance Agency Inc., we work collaboratively to frame the ideal level of coverage that matches your needs. As homeowners insurance experts, we address all your doubts and clarify what homeowners insurance can and cannot do.

Want insurance assistance? Contact us today to ascertain your homeowner’s insurance coverage needs and discover the most fitting policy for your home.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions